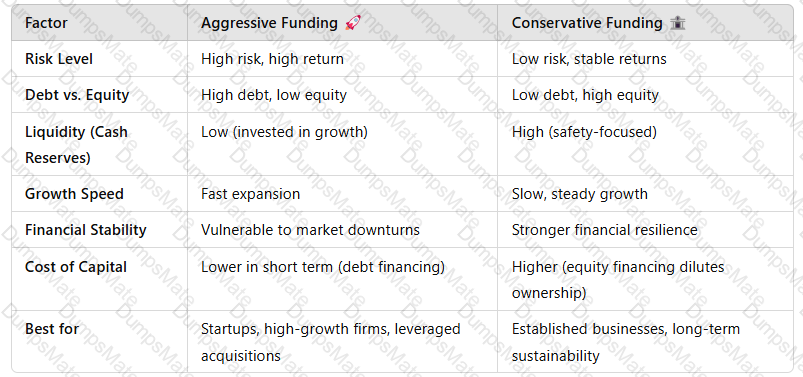

Comparison of Aggressive vs. Conservative Business Funding Approaches

Introduction

Businesses adopt differentfunding strategiesbased on theirrisk tolerance, growth objectives, and financial stability. Two contrasting approaches to business funding are:

Aggressive Funding Approach– Focuses onhigh-risk, high-reward strategieswithmore debt and short-term financingto fuel rapid expansion.

Conservative Funding Approach– Emphasizesfinancial stability, risk aversion, and long-term security, often relying onequity and retained earningsto fund operations.

Each approach has advantages and risks, influencing a company’sliquidity, cost of capital, and financial sustainability.

1. Aggressive Business Funding Approach????(High Risk, High Reward)

Definition

Anaggressive funding strategyinvolves maximizingshort-term debt, high leverage, and minimal cash reservestoaccelerate growth and expansion.

✅Key Characteristics:

Relies heavily on debt financing(bank loans, corporate bonds, short-term credit).

Prioritizes rapid growth and high returnsover financial security.

Uses minimal equity financingto avoid ownership dilution.

Maintains low cash reserves, assuming cash flows will cover liabilities.

????Example:

Startups and tech firms (e.g., Tesla, Uber, Amazon in early years)oftenborrow aggressivelyto scale rapidly.

Private equity firmsfund acquisitions using high leverage to maximize returns.

Advantages of Aggressive Funding

✔Faster business expansion– Capital is readily available for investments.✔Higher return potential– More funds are allocated to revenue-generating activities.✔Lower equity dilution– Existing shareholders maintain control as funding is primarily debt-based.

Disadvantages of Aggressive Funding

❌High financial risk– Heavy debt increases vulnerability to economic downturns.❌Liquidity problems– Low cash reserves can cause issues during slow revenue periods.❌Higher borrowing costs– Lenders charge higher interest due to the risk involved.

????Best for:Fast-growing companies, high-risk industries, and businesses with predictable cash flows.

2. Conservative Business Funding Approach????(Low Risk, Long-Term Stability)

Definition

Aconservative funding strategyfocuses onlow debt levels, high liquidity, and long-term financingto ensurefinancial stability and steady growth.

✅Key Characteristics:

Uses retained earnings and equity financingover debt.

Minimizes reliance on short-term creditto avoid financial pressure.

Maintains high cash reservesfor financial security.

Focuses on steady, sustainable growthrather than rapid expansion.

????Example:

Berkshire Hathaway (Warren Buffett’s company)follows aconservative funding model, relying on retained earnings rather than excessive debt.

Family-owned businessesoften prioritize financial stability over rapid expansion.

Advantages of Conservative Funding

✔Lower financial risk– Reduces dependence on external creditors.✔Stable cash flow– Ensures business continuity during economic downturns.✔Better credit rating– Stronger financial health allows for lower borrowing costs if needed.

Disadvantages of Conservative Funding

❌Slower business growth– Limited access to capital can restrict expansion.❌Missed market opportunities– Competitors with aggressive funding may outpace the company.❌Higher cost of capital– Equity financing (selling shares) dilutes ownership and reduces profit per share.

????Best for:Established businesses, risk-averse industries, and companies focusing on long-term sustainability.

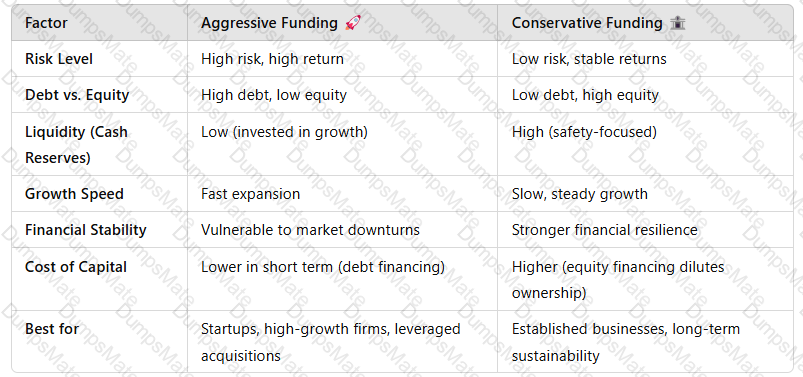

3. Comparison Table: Aggressive vs. Conservative Funding Approaches

A screenshot of a computer screen

Description automatically generated

A screenshot of a computer screen

Description automatically generated

Key Takeaway:The best funding approach depends onindustry, company stage, and risk appetite.

4. Which Approach Should a Business Use?

✅Aggressive Approach is Ideal For:

Startups & High-Growth Companies– Needfast capitalto capture market share.

Businesses in Competitive Markets– Companies that mustoutpace rivals through aggressive expansion.

Private Equity & Leveraged Buyouts– Maximizing returns throughhigh debt strategies.

✅Conservative Approach is Ideal For:

Mature & Stable Businesses– Companies prioritizingsteady revenue and financial security.

Family-Owned Enterprises– Owners preferlow debt and long-term growth.

Risk-Averse Industries– Businesses inessential goods/services sectorswherestability is more important than rapid expansion.

Hybrid Approach: The Best of Both Worlds?

????Many businesses use a combination of both approaches, leveragingdebt for growth while maintaining financial stabilitythrough retained earnings and equity.

????Example:

Appleused a conservative strategy in its early years but adoptedaggressive funding for global expansionpost-2010.

5. Conclusion

The choice betweenaggressive and conservative fundingdepends on a company’sgrowth goals, financial risk tolerance, and industry conditions.

✅Aggressive funding maximizes short-term growthbut increases financial risk.✅Conservative funding ensures stabilitybut limits expansion speed.✅Most companies use a hybrid modelto balancegrowth and financial security.

Understanding these approaches helps businessesoptimize capital structure, manage risk, and align financing with strategic objectives.

A screenshot of a computer screen

Description automatically generated

A screenshot of a computer screen

Description automatically generated