Factors Affecting Financing, Investment, and Dividend Decisions in Private Sector Organizations

Introduction

Private sector organizations must carefully balancefinancing, investment, and dividend decisionsto ensurefinancial stability, profitability, and shareholder satisfaction. These decisions are influenced byinternal financial health, external economic conditions, market competition, and regulatory requirements.

This answer examines thekey factors affecting financing, investment, and dividend policiesin private sector companies.

1. Factors Affecting Financing Decisions????(How Companies Raise Capital?)

Financing decisionsdetermine how businessesfund operations, expansion, and debt repayment.

1.1 Cost of Capital????(Debt vs. Equity Considerations)

✅Why It Matters?

Companies choose betweendebt financing (bank loans, bonds)andequity financing (selling shares)based on thecost of capital.

Higher interest ratesmake debt financing expensive, while equity financing dilutes ownership.

????Example:

A startup may prefer equity financingto avoid immediate debt repayments.

A profitable company may use debtdue totax advantages on interest payments.

????Key Takeaway:Companies aim tominimize capital costswhile maintaining financial flexibility.

1.2 Company’s Creditworthiness & Risk Tolerance⚖️

✅Why It Matters?

Stronger credit ratingsallow companies to secure loans atlower interest rates.

Riskier businesses maystruggle to secure financingor facehigh borrowing costs.

????Example:

Apple can easily issue corporate bondsdue to its strong financial position.

A high-risk startup may have to offer higher interest rateson its debt.

????Key Takeaway:Financially stable firms havemore funding options at lower costs.

1.3 Economic Conditions????(Market Trends & Inflation)

✅Why It Matters?

Ineconomic downturns, companies avoid excessive borrowing.

Inflation and interest rate hikesincrease financing costs.

????Example:

Duringrecessions, companies reduce borrowing to avoidhigh debt risks.

In abooming economy, firms take loans toexpand production and capture market share.

????Key Takeaway:Businesses adjust financing strategies based oneconomic stability and interest rates.

2. Factors Affecting Investment Decisions????(Where and How Companies Invest Capital?)

2.1 Expected Return on Investment (ROI)????

✅Why It Matters?

Companies evaluate potentialprofits from investmentsbefore committing capital.

High-ROI projects are prioritized, while low-ROI investments are avoided.

????Example:

Tesla invests in battery technologydue to high future demand.

A retail chain avoids investing in struggling marketswith low profitability.

????Key Takeaway:Businesses prioritizehigh-return investmentsthat align with strategic goals.

2.2 Risk Assessment & Diversification????

✅Why It Matters?

Companies assessmarket, operational, and financial risksbefore investing.

Diversification reduces reliance on asingle revenue source.

????Example:

Amazon diversified into cloud computing (AWS)to reduce dependence on e-commerce sales.

Oil companies invest in renewable energyto hedge against declining fossil fuel demand.

????Key Takeaway:Investment decisions focus onbalancing risk and opportunity.

2.3 Availability of Internal Funds vs. External Borrowing????

✅Why It Matters?

Companies useretained earningswhen available toavoid debt costs.

When internal funds are insufficient, theyborrow or raise equity capital.

????Example:

Google reinvests profits into AI and software developmentinstead of taking loans.

A new airline expansionmay requiredebt financing for aircraft purchases.

????Key Takeaway:Investment decisions depend onfund availability and cost considerations.

3. Factors Affecting Dividend Decisions????(How Companies Distribute Profits to Shareholders?)

3.1 Profitability & Cash Flow Stability????

✅Why It Matters?

Profitable companiespay higher dividends, while struggling firms reduce payouts.

Strong cash flow ensuresconsistent dividend payments.

????Example:

Microsoft pays regular dividendsdue to itssteady revenue stream.

A startup reinvests all profitsinto business growth instead of paying dividends.

????Key Takeaway:Onlyprofitable, cash-rich companiessustain high dividend payouts.

3.2 Growth vs. Payout Trade-Off????

✅Why It Matters?

High-growth firmsreinvest profitsfor expansion instead of paying high dividends.

Mature companies withstable profitsfocus on rewarding shareholders.

????Example:

Amazon reinvests heavily in logistics and AIrather than paying high dividends.

Coca-Cola pays consistent dividendsas its industry growth is slower.

????Key Takeaway:Companies balancegrowth investment and shareholder returns.

3.3 Shareholder Expectations & Market Perception????

✅Why It Matters?

Investors expect dividends, especially inblue-chip and income-focused stocks.

Suddendividend cutscan signalfinancial trouble, affecting share prices.

????Example:

Unilever maintains stable dividendsto attract income-focused investors.

Tesla does not pay dividends, focusing on long-term growth and innovation.

????Key Takeaway:Dividend policies affectinvestor confidence and stock valuation.

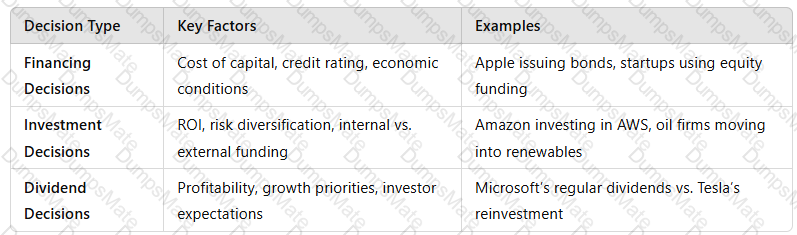

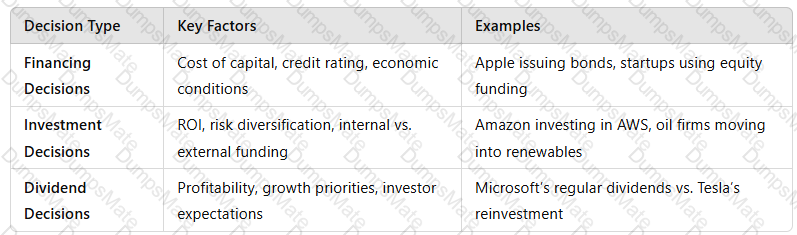

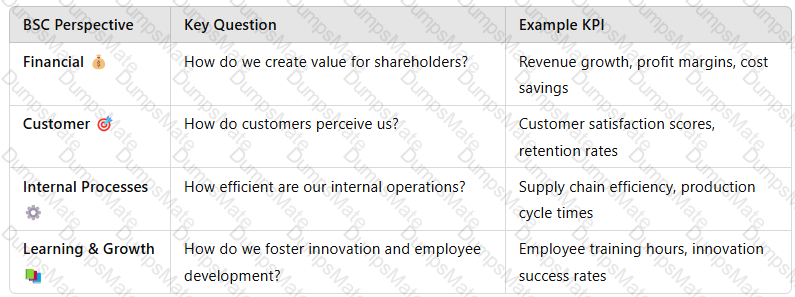

4. Summary: Key Factors Influencing Financial Decisions

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated

Key Takeaway:Companiesbalance financing, investment, and dividend decisionsbased onprofitability, risk assessment, and market conditions.

5. Conclusion

Private sector companies makestrategic financial decisionsby evaluating:

✅Financing Needs:Debt vs. equity, cost of borrowing, and risk management.✅Investment Priorities:Expected ROI, business growth, and market opportunities.✅Dividend Strategy:Balancing shareholder returns and reinvestment for growth.

Understanding these factors helps businessesmaximize financial performance, shareholder value, and long-term sustainability.

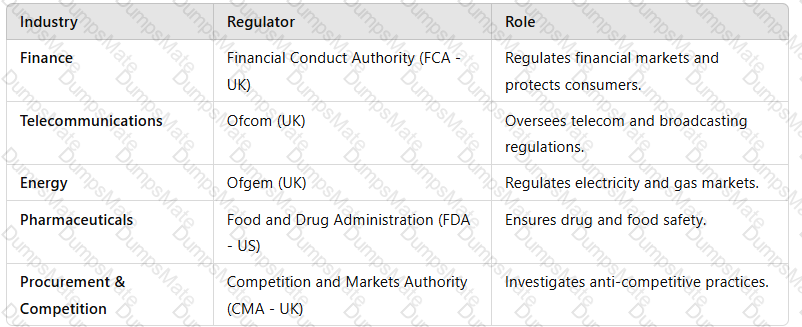

A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated A screenshot of a computer

Description automatically generated

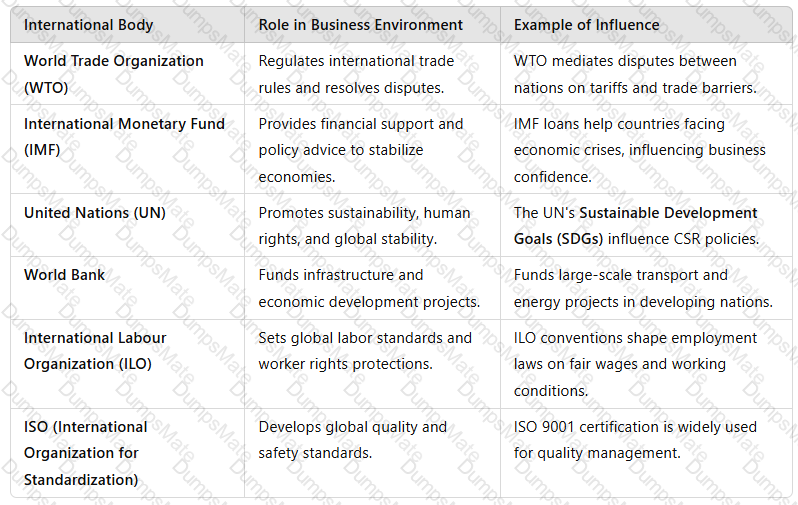

A screenshot of a computer

Description automatically generated A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated A screenshot of a computer

Description automatically generated

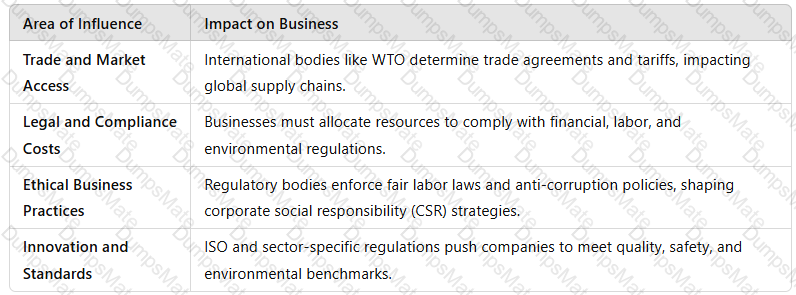

A screenshot of a computer

Description automatically generated A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated A table with text on it

Description automatically generated

A table with text on it

Description automatically generated A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated A screenshot of a computer

Description automatically generated

A screenshot of a computer

Description automatically generated