24/7 Customer Support

DumpsMate's team of experts is always available to respond your queries on exam preparation. Get professional answers on any topic of the certification syllabus. Our experts will thoroughly satisfy you.

Site Secure

TESTED 29 Apr 2025

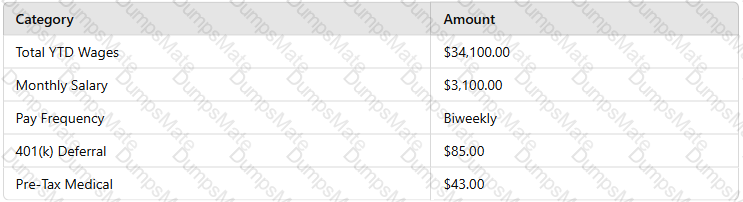

A screenshot of a computer screen

AI-generated content may be incorrect.

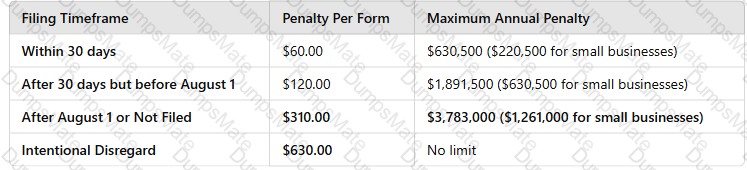

A screenshot of a computer screen

AI-generated content may be incorrect.