David had $10,000 in his investment account with Dynamic Investments, a mutual funds dealer. On June 28, David wants to buy 500 units in ABC Canadian Dividend Fund that has a Net Asset Value Per Unit (NAVPU) of $14.10. His friend Robert suggests that he may get a better price if he used the strategy of dollar-cost averaging. David then instructs his Dealing Representative to place a purchase order for 100 units on the first of every month starting July 1st for the next 5 months.

The orders are executed at the following NAVPUs.

July 01, $14.00

Aug. 01, $14.50

Sep. 01, $15.00

Oct. 01, $14.25

Nov. 01, $16.50

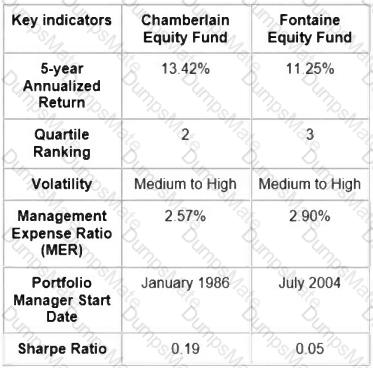

Did David get a better purchase price following the dollar-cost averaging strategy compared to making a lump-sum purchase of 500 shares on Jun 28, 20xx?